What are Carbon Markets?

Carbon markets are marketplaces where regulated entities can purchase and trade carbon offsets or credits in order to meet predetermined regulatory targets. Carbon offsets are typically generated through projects that reduce greenhouse gas emissions, such as planting trees or investing in renewable energy. By trading in the carbon market, businesses and governments can offset their own emissions and help to finance emission-reduction projects around the world.

An increasing percentage of voluntary carbon offsets are likely to be generated through carbon markets. These markets are marketplaces where businesses and governments can buy and sell allowances or credits in order to offset their emissions. In many cases, the carbon credits traded in these markets will be used to finance emission-reduction projects.

The two most common types are compliance carbon markets and voluntary carbon markets. In compliance markets, cap-and-trade systems set a limit (or “cap”) on overall greenhouse gas emissions and then issue tradable allowances that entities can use to offset their emissions. The voluntary market is not regulated by governments, but instead relies on businesses and organizations voluntarily choosing to offset their emissions.

Carbon markets can be an important tool in the fight against climate change. By putting a price on carbon, they provide an incentive for businesses and individuals to reduce their emissions. And by funding emission-reduction projects, they help to accelerate the transition to a low-carbon economy.

Carbon Markets in China

The government of China is piloting the China Certified Emission Reduction (CCER) scheme, a national carbon market that will eventually cover the entire country. The country is the world’s largest emitter of greenhouse gases, and its market will be the largest in the world. The launch of the carbon market is a significant step forward in China’s efforts to combat climate change.

European Union

In the European Union, the Emissions Trading System (ETS) is the world’s first and largest compliance market. The ETS covers around 11,000 power plants and manufacturing facilities in 30 countries, accounting for over 40% of the EU’s total emissions.

United States

The United States has several voluntary markets, but no nationwide compliance market. However, many states have implemented their own cap-and-trade programs, and there is growing interest in creating a federal carbon market.

Voluntary Carbon Markets

Voluntary Carbon Markets (VCMs) are marketplaces where businesses and organizations can buy and sell carbon offsets in order to offset their emissions. VCMs are not regulated by governments, but instead rely on businesses and organizations voluntarily choosing to participate.

The voluntary market is growing rapidly, with the common type of offset traded being the Verified Carbon Standard (Verra) offset. Verra offsets are generated through projects that reduce greenhouse gas emissions, such as planting trees or investing in renewable energy.

To date, the vast majority of offsets traded in the voluntary market have been project-based offsets. These offsets are generated through specific projects, such as renewable energy projects or forest Conservation programs.

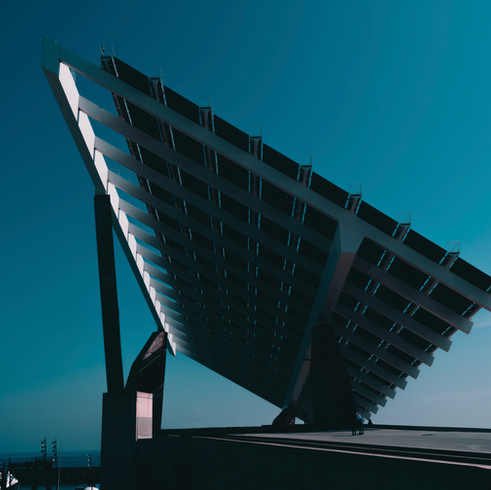

This trend is already underway in California, where the state’s carbon market has been used to finance a variety of emission-reduction projects, including solar power plants and electric vehicle charging stations.

The growth of the voluntary market provides an important opportunity for businesses and organizations to offset their emissions. By voluntarily participating in these markets, businesses and organizations can help to finance the transition to a low-carbon economy.

Compliance Carbon Markets

Compliance Carbon Markets (CCMs) are marketplaces where businesses and organizations obtain and surrender emissions permits (allowances) or offsets in order to meet predetermined regulatory targets. CCMs are typically established by governments in order to achieve specific environmental objectives, such as reducing greenhouse gas emissions.

What is a Carbon Offset?

A carbon offset is a unit of greenhouse gas reduction that is used to offset an emission of greenhouse gases. They are generated through projects that reduce emissions, such as planting trees or investing in renewable energy.

One way to think of a carbon offset is as a “greenhouse gas credit.” Just as businesses can buy and sell credits in the financial markets, they can also buy and sell credits in the carbon market. Offsets can be used to offset emissions from any source, including power plants, factories, cars, and airplanes.

Verified Carbon Standard

The most common type of offset traded in the voluntary carbon market is the Verified Carbon Standard (Verra) offset. Verra offsets are generated through projects that reduce greenhouse gas emissions, such as planting trees or investing in renewable energy.

Gold Standard

Gold Standard offsets are another type of offset that is commonly traded in the voluntary market. Gold Standard offsets are generated through projects that meet a stringent set of environmental and social criteria.

Clean Development Mechanism

The Clean Development Mechanism (CDM) is a compliance carbon market that was established by the Kyoto Protocol. The CDM allows businesses and organizations in developed countries to offset their emissions by investing in emission-reduction projects in developing countries.

Joint Implementation

Joint Implementation (JI) is another compliance market that was established by the Kyoto Protocol. JI allows businesses and organizations in developed countries to offset their emissions by investing in emission-reduction projects in other developed countries.

International Civil Aviation Organization Carbon Offsetting Scheme for International Aviation

The International Civil Aviation Organization (ICAO) has established a carbon offsetting scheme for international aviation. Under this scheme, airlines will be required to offset their emissions by purchasing credits from approved carbon offset projects.